Podcast: Play in new window | Download

Updates:

- Lynne Stewart Update

- Please Write to Lynne at:

- LYNNE STEWART, # 53504-054 /

- FMC CARSWELL / FEDERAL MEDICAL CENTER UNIT 2N

- PO BOX 27137 / FT. WORTH, TX 76127

- You Have The Right To Remain Silent Booklet

—

Days of Destruction Days of Revolt – Chris Hedges

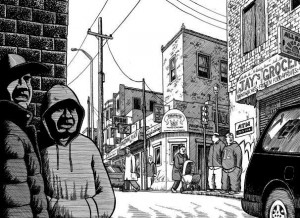

We go now to an interview with Pulitzer-Prize winning author and journalist Chris Hedges. His latest book Days of Destruction Days of Revolt sends a powerful message about the perils of staying on the current destructive track in post capitalist America. The book is also filled with line drawing graphics, illustrating some of the most depraved areas in the United States. The book explores what Chris describes as the country’s sacrifice zones, areas that have been torn apart in the name of greed, progress and technological advancment. These areas include the streets of Camden New Jersey, the coal fields of West Virgina, the Lakota reservation of Pine Ridge in South Dakota. This interview was recorded live during a WBAI fund raiser.

- One of my frustrations is the people who keep plowing back their hopes into the democratic party and the formal structures of power. If you challenge the approved narrative (political debates) you’re out.

- When you look at the structures of power and you grasp what we’ve undergone is a corporate coup de tat in slow motion, starting with the Reagan Administration.

- It’s utterly impossible within the system to vote against the interest of Goldman Sachs.

- Karl Marx: his analysis of capitalism is pretty remarkable.

- They understand that unfettered, unregulated capitalism is a revolutionary force. It knows no limits. It will commodify everything until it destroys it – until exhaustion or collapse.

- Since there are no impediments within the mechanisms of power to disrupt essentially a corporate cannibalization then the only thing to impede that is popular unrest.

- Book – Anatomy of Revolution

- What they (Occupy Movement) fundamentally wanted was something the power elite couldn’t hear.

- They wanted to rest power back from the hands of a corporate oligarchy class and put back in the hands of citizens.

- A democratic administration was behind a coordinated federal effort to shutdown the Occupy Encampment.

- When Marx and Engels did their work they did a very close study of the Iroquois in how they governed themselves and functioned as a society.

- We begin with an indigenous culture essentially about breaking a culture replacing a self sufficiency and dignity with a culture of dependence.

- What that engenders is this horrific despair that consumes to this day in indigenous communities.

- The average expectancy for males in Pine Ridge is 48. That’s the lowest in the Western hemisphere except for Haiti.

- We are fed this utopian ideology that if somehow we build our culture and society around the demands of the marketplace we’ll get some sort of utopian heaven on Earth.

- We didn’t want a book of polemics, you couldn’t argue with what’s taken place.

- Immokalee becomes emblematic with what the corporate state wants.

- Workers are told they have to be competitive in a global market place which means being competitive with sweat shop workers in Bangladesh.

- It’s only through acts of disobedience and civil resistance that we have any hope.

- The decision to completely erase the Occupy Encampment exposed their hand.

- There is a backlash outside the traditional mechanisms of power.

- Hundreds of thousands of Americans have lost their unemployment benefits.

Guest – Chris Hedges, Pulitzer-Prize winning author and journalist. He was also a war correspondent, specializing in American and Middle Eastern politics and societies. His most recent book is ‘Death of the Liberal Class (2010). Hedges is also known as the best-selling author of War is a Force That Gives Us Meaning (2002), which was a finalist for the National Book Critics Circle Award for Nonfiction.

—

Occupy the Economy: Challenging Capitalism PART 2

Occupy the Economy: Challenging Capitalism is the title of Professor Rick Wolff’s new book. After more than a dozen interviews with Rick Wolff since 2008, the theme is consistent, beyond the corrupt banks and stock markets is a flawed economic system. A system that at worst needed to change direction in the 1970s when wages stopped increasing and the cost of living continued to rise. As we look around, the collapse has been coming down in steps, and many have been trying to dial back, save and prepare. This, as millions have lost their jobs, 401ks, pensions, and homes. Overseas, the waves of austerity continue to push through Europe as protests have erupted again in Spain.

- The book is an interesting venture for me, it’s done with David Barsamian, with Alternative Radio.

- He did 3 major interviews with me, the response was so heartwarming, we published a written version of them.

- The book is an overview of how we got into this mess, why it’s lasting so long, why it’s hurting so badly, why government policies have in fact, not succeeded.

- A number of the economies in Europe are on the edge of major breakdown. Spain is already in that situation, Italy is right on its heels. This is not like Greece or Portugal, Ireland or Hungary who are smaller economies, these are major economies.

- There is active debate in the highest circles of Europe, both critics of capitalism and its leaders, questioning whether the European Union can survive . . its a measure of how serious the problem is.

- China, by its own announcing running at a rate of growth of 7- 8 percent which is half of what it had very few years ago.

- It can’t also escape the effect of Europe which is its second most important market.

- China is trying to reorient the economy away from their dependence from exports to the rest of the world because frankly that’s not a reliable situation for them. To give you one index.

- As wages in the United States stagnated, wages in China have gone up 20 percent.

- The slow downs in India, very sharp. The slow downs in Brazil, very sharp.

- The consensus is what Bernanke said. Things are very poor, very weak and we really have to be alert.

- The situation is only going to deteriorate over the rest of 2012 and into early 2013.

- When a capitalistic economic system begins to unravel. . . we’re in the fifth year of this crisis. It officially began in December 2007.

- Every major government program, the bailouts, the stimulus has not achieved the goals it said it could and would.

- The biggest capitalist institutions in this country at this time, the banks. . .are in such trouble are so worried about their own prospects in an economy in such difficulty that what they are doing is taking excessive risks, pushing the envelope of what’s ethical and moral and crossing the thin and blurry lines of legality.

- LIBOR – London Interbank Offered Rate – Starting in the 1980s, London which had been the financial center of the world economy realized what we all understood at that time which was the world economy was becoming dependent on credit.

- Every corporation was borrowing money all the time, every government was borrowing money on a scale we’ve never seen before, the really innovative thing was the development of consumer credit.

- The LIBOR became the benchmark for the world.

- Everyday the British Bankers Association polls the 16 biggest banks who have offices in England, what they are charging each other.

- It takes an average and it announces that. That number is a standard number for example, variable rate mortgages in the US where the mortgage goes up and down those are based on LIBOR.

- It’s factored into everybody’s borrowing. If you’re going into store to buy a pair of pants, that store also borrowed money which is also shaped by a relationship to LIBOR.

- These banks are the biggest holders of debt instruments. Derivatives of all kinds, mortgages of all kinds. You are relying on information from somebody who has an active interest in the information they’re supplying.

- What we now know is these banks often reported an interest rate different from what they were actually charging.

- There was no oversight.

- The world of superbanking is a very cozy world. Barclay’s had admitted to reporting a number that was actually the case. . . and had paid fines now totalling 450 million dollars to both US and British authorities.

- To be blunt they screwed everybody to save themselves.

- How could we defend private banking on this scale ever again?

- The big ones are Bank America and Wells Fargo.

- Both of them have both agreed to pay fines. Bank of America – 300 million. Wells Fargo 175 million.

- Here was what their fine was for. They went and charged African American and Hispanic families more interest for mortgages than they did for whites who had identical credit scores.

- Five of the biggest banks in the world Barclays, Wells Fargo, HSBC, and JP Morgan Chase have all admitted major breaches of minimal ethics, minimal morality, legality all to advantage themselves at the expense of the public.

- Private monster banks are an unsafe way for any society to manage the credit that has now become central to the economy. It is inappropriate for us to have banks that have more money than the government supposedly regulating them.

Guest – Richard D. Wolff is Professor of Economics Emeritus, University of Massachusetts, Amherst where he taught economics from 1973 to 2008. He is currently a Visiting Professor in the Graduate Program in International Affairs of the New School University, New York City. He also teaches classes regularly at the Brecht Forum in Manhattan.