Podcast: Play in new window | Download

IRS Allows Private Prison Corporation Tax Exemption Status

Billboard companies, casinos and private prisons are among many American corporations declaring the status of special trusts in order to avoid paying federal taxes. The Corrections Corporation of America which owns and operates 44 prisons and detention centers in the United States has quietly received permission by the Internal Revenue Service to switch it’s status saving millions on taxes. These special trust structures however are usually reserved by funds holding real estate. As we’ve discussed on Law and Disorder handing over state related tasks such as running penal institutions to the private sector is often at the expense of the inmates’ welfare.

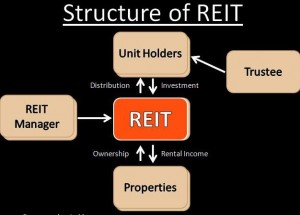

- REIT is increasingly popular these days as an investment choice by both some institutions and individuals.

- REIT’s by law have advantageous tax treatment, its a legal structure of ownership and it requires you to get a better tax structure to pay out 90 percent of your earnings in dividends.

- What you have is individuals and institutions, looking to get an income on their wealth and finding it difficult to find appealing incomes on that wealth.

- This drives them into the area of REIT, its a unit investment trust.

- The tax rates on dividends and capital gains are lower, than say the people who work for a living in standard jobs are then compensated then taxed.

- This was probably made famous in a comment by Warren Buffet who wrote a famous letter and proposed a solution now called the Buffet Rule.

- Tax based on labor income vs. investment income

- The real estate class of investments enjoys any number of special abilities to generate income and pay less taxes. One of them is ensconced in the law of Real Estate Investment.

- The Corrections Corporation of America, private prisons – – if they are a unit investment trust, and they do get their income from rents, from a variety or type, from a property or type, its a prison, then they can get tax exempt treatment.

- Once you have a popular with investors category that can also receive advantageous tax treatment, then teams of lawyers will go out and get to work with economists and accountants and figure out how to shove everything they possibly can into that bucket.

- The regulators are usually a bit behind, in the staffing and acumen of their various attorneys. We call it regulation arbitrage.

- Anytime you can take a series of assets and reduce the tax burden on those assets, it means the various state and local authorities depending or needing those tax revenues, will go without.

- We’ll see more regressive taxes, in terms of more lottery tickets sold, hitting the general public for more money or reducing services.

- Part of what we’re seeing here is privatization of public assets.

- The United States of America has a fairly high corporate tax rate, legal not effective. 35 percent corporate tax rate.

- Once you’re a multinational enterprise you will try to pay taxes in whatever jurisdiction has the lowest rate.

- At one point in the 50s and 60s corporations paid about 30 percent of their income to the federal government in taxes. As we sit and chat now in New York City, they pay about 8 percent of the taxes.

- Tax avoidance strategy, Dutch Double Irish, its done by most of the leading tech companies. Maybe most aggressively pursued by Apple.

- Hundreds of thousands of people make a good living helping people pay less taxes.

- We now know its hundreds of billions of dollars in money that the government didn’t collect.

- The middle, upper middle class American is paying virtually the entire tax bill.

- Very very affluent Americans are able to off-load significant portions of their tax liability and large corporations.

Guest – Max Wolff – teacher of economics in the New School University Graduate Program in International Affairs. He’s

Senior Analyst & Chief Economist at Greencrest Capital. Mr. Wolff is an economist specializing in international finance and macroeconomics. Before joining Greencrest Capital he spent four years as the senior hedge fund analyst at the Beryl Consulting Group, LLC. Mr. Wolff teaches finance and statistical research methods in the New School University’s Graduate Program in International Affairs. Mr. Wolff’s financial markets and macroeconomics work appears regularly in Seeking Alpha, The Wall Street Journal, Reuters, Bloomberg, The BBC, Russia Today TV, and Al Jazeera English.

——-

Bush Library Direct Action: We Will Not Be Silent

Late last month in Dallas, Texas, four living presidents and countless dignitaries attended the opening of the Bush Library. In response to the library opening, relegated to the so called free speech zone across the street were the members of the white masked group, March of the Dead. While George W. Bush was being celebrated a procession of We Will Not Be Silent marchers carried the names of many who lost their lives in Afghanistan, Iraq, Bagram, Abu Ghraib and Guantanamo prisons. The marchers also carried names of civilians, US military and detainees tortured to death because of war crimes committed by the Bush Administration. WeWillNotBeSilent.net

- We made some signs just for this and the one we designed was The Bush Library: A Crime Against the Mind.

- Hearing that the library was opening, this was several years ago, I felt compelled that we had to be there.

- The organizing force behind this were people in Dallas.

- They organized something called the people’s response.

- We were invited to do something we did in Washington, the March of the Dead.

- So, the March of the Dead returned to the opening of the Bush Library.

- We searched names that lost their lives in prisons under the Bush regime.

- They call it a “free speech zone” which is really Orwellian, we call it a “no speech zone” where they try to render us invisible.

- We were across a highway, several lane highway. They even tried to take that away. They tried to use an old ordinance – you can’t hold a sign within 75 feet of a highway.

- A lot of people now know the truth about Iraq, that we shouldn’t have gone in there.

- There were no weapons of mass destruction, no imminent threat.

- Lawrence B. “Larry” Wilkerson is a retired United States Army Colonel and former chief of staff to United States Secretary of State Colin Powell says we invaded Iraq because of oil.

- We have a war criminal that is being honored by 4 other living presidents. I can understand his father showing up, but Barack Obama, Clinton, Carter, caught in pictures that the media showed, laughing and joking around . . ?

- This man gave orders to torture people and admitted with his vice president on a book tour.

- How do you follow, with having men admit publicly that they did water-board, water boarding is torture, torture is a crime and the law is not coming to prosecute them.

- That’s a crime against our mind too and our intelligence.

- I also look at Lynne Stewart as another casualty in Bush’s war on terror.

- Sign Lynne Stewart Petition For Her Compassionate Release

- We pulled up right to the prison (where Lynne Stewart is currently being held) and about 15 of us came together, 2 of us from New York carrying signs that said “release Lynne Stewart, compassion, the right to justice, “

Guest – Laurie Arbieter helped coordinate the direct action at the opening of the George W. Bush Library, Laurie is an artist/activist and creator of the “We Will Not Be Silent” collective.

—————————————————————-