Podcast: Play in new window | Download

Updates:

- Pfc. Manning To Be Transferred To Army Prison

- New York State Assembly Passes Rent Regulation Bill

- Michigan: Police Search Cell Phones During Traffic Stops

- Using Emergency Powers to Dismantle Unions In Michigan – Update with Zainab Akbar Legal Fellow at the ACLU of Michigan

—–

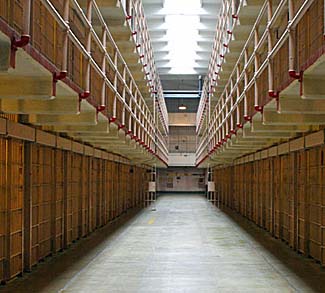

Last month, the Center for Constitutional Rights won the right for prisoners to challenge a violation of their constitutional rights. Prisoners in 2 experimental federal prison units called “Communications Management Units” or CMUs, will have their claims heard in court. About 70 percent of CMU prisoners are Muslim men. Judge Urbina agreed that the prisoners raised serious constitutional questions about CMUs. The Center for Constitutional Rights filed Aref v. Holder in the D.C. District Court on behalf of current and former prisoners of the units in Terre Haute, IN and Marion, IL; two other plaintiffs are the spouses of those prisoners.

As many listeners may know, these CMUs were secretly opened under the Bush administration in 2006 and 2007. They were designed to monitor and control the communications of certain prisoners and to isolate them from other prisoners and the outside world. The five plaintiffs in Aref were designated to the two CMUs despite having relatively or totally clean disciplinary histories, and none of the plaintiffs have received any communications-related disciplinary infractions in the last decade.

In addition to heavily restricted telephone and visitation access, CMU prisoners are categorically denied any physical contact with family members and are forbidden from hugging, touching or embracing their children or spouses during visits.

- We’re very troubled about policies and conditions at these units. A number of the restrictions imposed at the CMUs are severe. They are truly cutting people off from their loved ones, they’re community and the outside world

- Blanket ban on physical contact, unparalleled to any other single unit anywhere, including Supermax.

- We feel this needlessly impinges on their right to family integrity and their need to maintain these ties to the outside world.

- What we’re challenging is that there is no due process attached to designation to these (CMU) units.

- Without a disclosure of factual allegations that were used to designate them, without a demonstration of past abuse of communication devices, without a hearing, without an appeal. Once you’re there, no one is told how to earn their transfer to get out. Our clients have benign or in some cases perfectly clean histories.

- What is happening is that Muslim prisoners are being designated there, based on the discriminatory belief that as Muslims they inherently pose a great danger to institutional security, than do other prisoners.

- We’re very concerned also about a pattern of designation of political prisoners and specifically includes environmental and animal rights activists.

- We do believe these are acts of retaliation for protected First Amendment activity, such as speaking out on social justice issues.

- What we’ve asked for in the case is a thorough review of polices and practices in the CMUs.

- What’s next is we’re going into discovery, which is our opportunity to learn a lot more about the CMUs, about their inception, who was involved in designing them and why and about how designations are made.

- CMUs were opened quietly.

Guest – Alexis Agathocleous, staff Attorney at the Center for Constitutional Rights and works on CCR’s Government Misconduct and Racial Justice docket. He is lead counsel in Aref v. Holder, challenging policies and conditions at the federal Bureau of Prisons’ Communications Management Units, and Doe v. Jindal, challenging a Louisiana law that requires individuals convicted of Crime Against Nature to register as sex offenders.

—–

Financial Regulators Failed: Crooks Go Unpunished

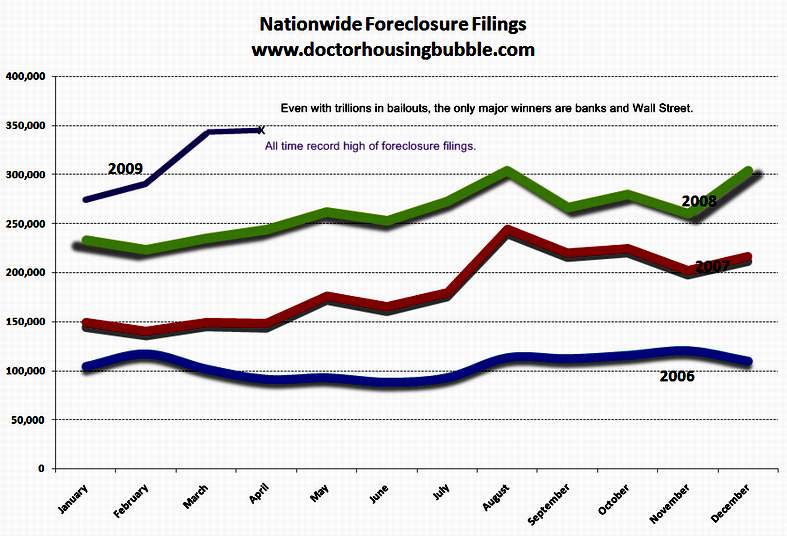

Last week, the Securities and Exchange Commission Friday charged Goldman Sachs & Co. and one of its executives with fraud in a risky offshore deal backed by subprime mortgages that cost investors more than $1 billion. The SEC also contends that Goldman allowed a client, Wall Street hedge fund Paulson & Co., to help select the securities to be sold. Paulson in turn bought insurance against the deal and when the securities sank, losing nearly all value, Paulson then made a $1 billion profit.

While these are not criminal charges, the recently released 650-page report of the Senate Permanent Subcommittee on Investigations, Wall Street and the Financial Crisis (PDF) had exposed the deceptive and risky practices within major financial institutions, that deceived clients and the public. New Economics Perspective Blog

- Many people still call it the subprime crisis, it would be far better to call it, the liar’s loan crisis.

- Roughly half of all subprime loans by 2006.

- Somewhere between a quarter and 49 percent of new home loans, were in the form of liar’s loans.

- The incidence of fraud when there have been independent studies has ranged from 90 to 100 percent.

- A liar’s loan is when there is no underwriting, no verification of what’s put into the loan application.

- Overwhelmingly, it was the lenders who put the lie is liar’s loans.

- You can sell these loans in the secondary market if they appeared to have 2 characteristics that finance has told us you can’t have simultaneously.

- A premium interest rate and low risk. You could have the best of both worlds. The way to do that was to gimmick two ratios. Debt to income ratio and loan to value ratio.

- Inflating the value of homes, covered up by industry. An honest secure lender would never inflate value.

- It makes perfect sense for a fraudulent company to inflate the value of the house so they can sell the loan on the secondary market for a higher profit.

- Then Attorney General Cuomo, now governor found this as a common practice at Washington Mutual, the biggest bank failure. WAMU had a blacklist of appraisers, you were blacklisted if you refused to inflate value of property. None of these people are being prosecuted.

- In 2004, the FBI testified there was an epidemic of mortgage fraud and predicted that it would cause a financial crisis.

- The Savings and Loans debacle cost 150 billion, the current crisis is costing over 10 trillion.

- The Office of Thrift Supervision, Chainsaw James Gilleran

- Instead of being embarrassed that they were working hand in glove with the lobbyists, they were proud of this and put this in their annual report.

- Geithner and Cuomo urged there not be investigations much less prosecutions of the elite financial frauds because he thought the financial system was too fragile.

- The Justice Department ruined an FBI initiative to try and investigate the elite frauds.

- If you are powerful enough, if you have enough ties, after citizens united, and make enough political contributions, you will not be prosecuted.

- You can’t have crony-capitalism and democracy either.

- Big finance is only supposed to be a middle man, it’s supposed to help the real economy, by simply allocating most efficiently capital to the most productive uses.

- Like any middle man you want absolutely minimal profits going to the middle man.

- Under some measures, finance has 40 percent of the total profits of all American businesses.

- This is the worst group of people you can possibly imagine having power.

- We’ve turned too many of our schools into fraud factories, where we train people how to gimmick accounting.

- Citizen’s United is a fragile case, it doesn’t make much sense in terms of the law.

- What these people are, engines for destroying wealth

- They only get 10 billion, they destroy 10 trillion dollars in wealth. They cost 10 million Americans their jobs.

Guest – William K. Black, a professor of law at University of Missouri, Kansas City who has criticized the absence of any criminal referrals or national task force to effectively punish the elite fraudsters. Professor Black teaches White-Collar Crime, Public Finance, Antitrust, Law & Economics.

——————————————————-